PART II _ Explore the critical issue of global health inequality and the far-reaching implications of wealth disparities worldwide in this article.

Widening Global Health and Wealth Gap

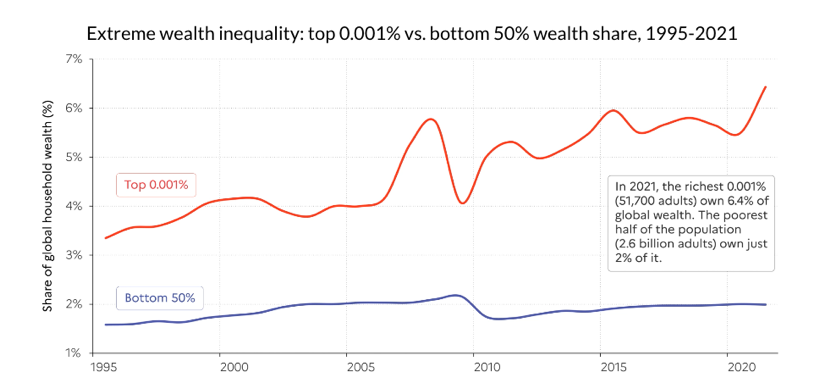

Extreme poverty increased in 2020 for the first time in 25 years. At the same time, extreme wealth has risen dramatically since the start of the global Covid-19 pandemic.

A 2023 report from Oxfam International shows that while the wealthiest global 1% captured 54% of new global wealth over the past decade, this has accelerated to 63% ($26 trillion) since 2020. Meanwhile, only 37% ($16 trillion) went to the bottom 99%.

A recent World Inequality Report confirms that 2020 marked the steepest increase in global billionaires' share of wealth on record.

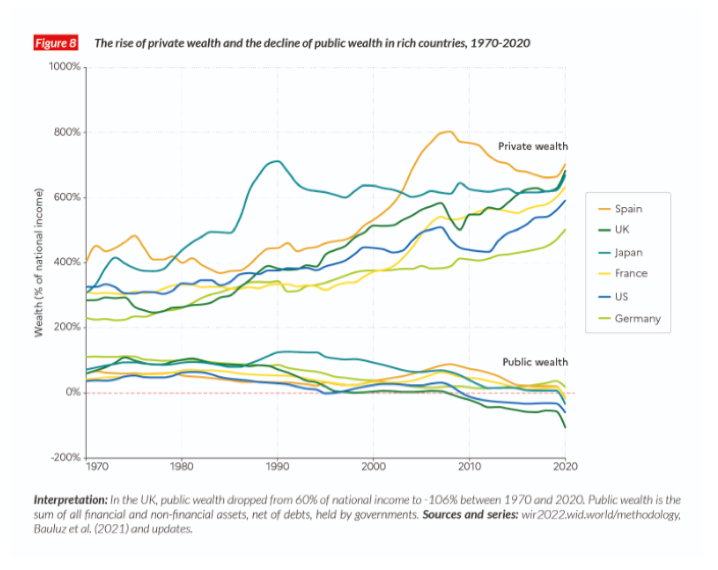

One approach to comprehending the magnitude of global wealth inequality involves examining the disparity between the net wealth of governments and that of the private sector.

In the last four decades, developed countries have experienced notable economic growth. Yet, their governments have faced substantial declines in wealth, meaning that the vast majority of wealth is in private hands.

The same World Inequality Report points out that the growth of private sector wealth was amplified by the COVID-19 crisis, during which governments borrowed the equivalent of 10-20% of GDP, mainly from the private sector.

The declining wealth of governments has important implications for states' capacities to tackle inequality in the future, let alone address some of the most critical challenges of the 21st century, such as climate change.

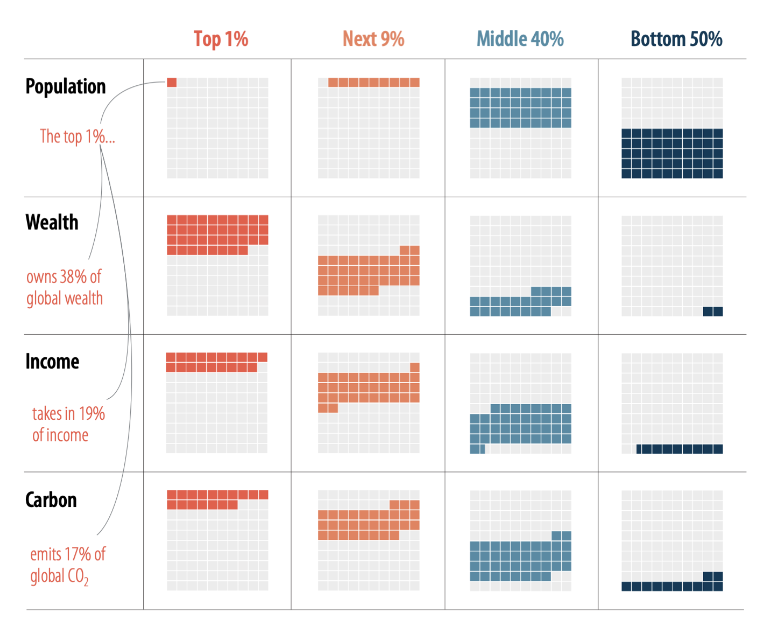

Notably, growing global income and wealth inequalities are connected to ecological disparities contributing to climate change.

The recent surge in billionaire wealth aligns with rising profits from food and energy production—two industries among the top contributors to carbon dioxide (CO2) emissions.

A recent report from Oxfam.org shows that 95 food and energy corporations more than doubled their profits in 2022. They made $306 billion in windfall profits and paid their shareholders 84% ($257 billion).

As a result, today, 10% of the world’s population owns 76% of the wealth, takes 52% of the income, and accounts for 48% of global carbon emissions.

Adam Smith, the 18th-century Scottish economist and philosopher widely regarded as the father of modern economics, offered valuable insights into the dynamics of inequality in the context of industrialization and property ownership, which are still relevant today.

Smith observed that cities were pivotal in generating wealth and inequality during the Industrial Age.

- Urbanization and Industrialization - With the rise of industrialization, urban areas experienced unprecedented growth as factories and manufacturing hubs emerged. This urbanization attracted a large labor force seeking employment opportunities, which, in turn, contributed to the concentration of wealth in cities. Property owners and industrialists were in a prime position to benefit from this shift as they owned the means of production.

- Profit from Property Ownership - Smith's observations underscored that property owners, particularly those with land or factories, could generate substantial income from their holdings. As the industrial sector expanded, these property owners gained more significant control over the factors of production, allowing them to accumulate wealth through rent, profits, and dividends.

To address the economic disparities and inequalities highlighted by Smith's observations, modern societies should consider adopting macroeconomic policies to stabilize economies and foster growth while mitigating the adverse effects of unchecked inequality.

Nurturing Global Social-Economic Imbalance at the National Scale

As a critical player in the global economy, the United States significantly influences the world's widening health and wealth gap. While one of the wealthiest nations, the U.S. has a complex relationship with global inequality.

The book “Hard Times,” by Charles Dickens describes the living conditions during the Industrial Revolution, provides insight into the challenges faced by the working class during this crucial period of American history, and highlights the economic inequality that was set in motion then and still impacts society today, including:

- The grim living conditions in industrial towns with overcrowded and polluted areas.

- The wealth gap between industrialists and laborers shows how some amassed fortunes while others struggled.

- The harsh realities of poverty and deprivation.

- Industrial hazards on the health, well-being, and livelihood of the people.

In the 2013 documentary Inequality for All, Robert Reich argues that income inequality is the defining issue of the United States. Inequality.org found that in October 2021, amid the COVID-19 pandemic, the wealth held by billionaires in the U.S. increased by 70%. Meanwhile, more working-age people (18-65) live in poverty in the U.S. than in any other nation belonging to the Organization for Economic Cooperation and Development (OECD).

What are the causes and effects of the United States' growing health and wealth gap?

Uniformity in Leadership Roles

Diversity is a crucial factor that drives innovation, fosters creativity, and ultimately improves investment outcomes.

Studies have repeatedly shown that diversity among leadership roles, such as executives and board members, improves profitability and investment outcomes. A recent Boston Consulting Group study found that companies with more diverse management teams have 19% higher revenues due to innovation.

Additionally, researchers from the University of Georgia found that, on average, firms appointing Black chief executives saw their market capitalization jump 3.1%.

While progress has been made in promoting diversity and inclusion in leadership roles, more is still needed. According to 2021 data from the Bureau of Labor Statistics, around 13% of all chief executives in the U.S. are Black or Hispanic. Just 21% of all S&P 500 directors in 2021 were from underrepresented racial and ethnic groups (Black, Asian American, Latinx/Hispanic, Native American, Alaska Native, or multiracial).

This lack of diversity in leadership roles is highly pronounced in key industries relating to the general welfare of U.S. citizens and the country's ability to pursue domestic and interstate commerce in several key sectors. For example:

- Transportation/Shipping - The transportation and shipping industry is vital in global trade and commerce. However, it continues to need more diversity. Minorities are significantly underrepresented in leadership positions and face barriers to entry at various levels.

- Research - Underrepresented groups, including women and minorities, often face systemic biases that hinder their progress and limit their opportunities for advancement in this field.

- High Tech - The high-tech industry has long been criticized for lacking diversity. Minorities are underrepresented in technical roles and leadership positions within tech companies. This lack of representation perpetuates inequality and limits the industry's ability to develop products and services catering to diverse consumer needs. Less than 2% of Executives in High Tech are Black compared to 83% White.

- Minority Farming Ownership - In the agricultural sector, minority farmers often face significant challenges competing against more extensive, established operations. Limited access to resources, discriminatory lending practices, and the lack of support systems contributes to the closure of many small minority-owned farms. Today, just 1.4% of farmers identify as Black or mixed race compared with about 14 percent 100 years ago.

Laissez-Faire Accountability and Fairness in the U.S. Financial Industry

Like any nation, the U.S. financial industry is a crucial pillar of its economy. As such, the financial sector needs greater accountability and fairness.

Recent events involving significant financial market players have exposed ongoing and unchecked systems of greed and a lack of accountability within the U.S. financial industry. Notable examples include:

- Enron and Arthur Andersen Scandal (exposed 2001) - Enron was an energy company that began to trade extensively in energy derivatives markets. The company hid massive trading losses, leading to one of the largest accounting scandals and bankruptcy in recent history. Arthur Andersen was one of the "Big Five" accounting companies.

- Madoff Ponzi Scheme (exposed 2008) - Bernie Madoff was a money manager responsible for one of the largest financial frauds in modern-day history. Bernie Madoff's Ponzi scheme, which likely ran for decades, defrauded thousands of investors out of tens of billions of dollars and finally came crashing down in 2008.

- Lehman Brothers (collapsed 2008) - Considered one of the major players in the global banking and financial services industries, Lehman Brothers declared bankruptcy in September 2008, mainly due to its involvement in the subprime mortgage crisis.

- FTX (collapse 2022) – This failed cryptocurrency exchange is said to have "expressed little interest in instituting appropriate oversight or a control framework.” The firm lacked vital executive roles, a cybersecurity department, and processes for detecting and handling security risks and joked internally about their tendency to lose track of millions of dollars in assets.

A common thread in each case has been the heady pursuit of short-term gains over long-term sustainability, leading to an environment where risks are underestimated and systemic contagion is overlooked.

A common thread in each case has been the heady pursuit of short-term gains over long-term sustainability, leading to an environment where risks are underestimated and systemic contagion is overlooked.

Multiple additional practices highlight the lack of accountability and fairness in the U.S. financial market, with a common theme of focusing on short-term gains rather than long-term sustainability, often underestimating risks and potential consequences.

Unsustainable Revenue Allocation Model

An unsustainable revenue allocation model leads to increasing wealth and income inequality, creating economic pressure that may not be sustainable.

As wealth and income inequality continue to rise, the pressure on the economic system becomes increasingly concerning.

The allocation of funds plays a critical role in determining the country's economic trajectory.

Lack of Capital Access for Underestimated Groups

Lack of capital access for underserved people in the U.S. remains a significant challenge, hindering their ability to participate fully in the economy, which, in turn, negatively impacts the general welfare of the people and the nation's economic growth.

Many underserved individuals and communities face barriers to capital access through loans, credit, grants, or investment opportunities.

A recent study by the Federal Reserve found that roughly 80% of white companies receive a part of or the entirety of the funding they seek. In comparison, minority-owned businesses receive the same result 66% of the time.

Despite this, a recent Center for American Entrepreneurship study found that American immigrants or their children founded 43% of Fortune 500 companies. Among the Top 35 companies, that share is 57 percent.

“If our nation is to remain globally competitive, we must leverage and engage our diversity, especially our minority entrepreneurs.” - Alejandra Castillo, National Director, Minority Business Development Agency.

Without affordable capital, aspiring entrepreneurs may struggle to start or expand businesses. At the same time, low-income households may find it challenging to finance essential expenses or invest in education and homeownership.

Implicit Home Bias in Investing

Implicit home bias in investing refers to investors' subconscious preference towards companies and industries based in their home country.

For example, U.S. equities represent about 60% of the global market. According to Charles Schwab, Americans invest 85% of their portfolios in domestic equities.

This bias can significantly influence investment decisions and the allocation of funds, leading to an over-concentration of investments in domestic markets. Investors may feel more familiar and comfortable with local companies, perceiving them as less risky. In contrast, foreign companies may be perceived as more uncertain or less accessible due to geographical and cultural differences.

However, this bias can have negative consequences, as it limits diversification opportunities and exposes investors to potential risks associated with a lack of exposure to global markets.

These and other recent instances of misconduct, unethical practices, or short-term views have eroded public trust and highlighted the urgent need for greater accountability, fairness, and inclusivity to promote the general welfare of the people and increase intrastate and foreign commerce.

Lack of Protection for Infant Industries, Key to Innovation

The absence of sufficient protection for infant industries, which are crucial for fostering innovation and economic growth, compounds the existing inequalities in the United States.

Adam Smith, the renowned economist, highlighted the significance of nurturing emerging industries. He argued that protecting and supporting these fledgling sectors could lead to more significant innovation and prosperity. However, in the contemporary U.S. landscape, the lack of adequate protection for such industries hampers their potential for growth and innovation.

As the disparities in health and wealth among different segments of the population continue to widen, the adverse effects ripple through various aspects of society. The marginalization of underserved groups is further exacerbated by the absence of policies and measures that would help level the playing field and promote the development of industries that could drive future economic success.

Unfair Financial Dealings

Underserved groups in the U.S. face systematic hurdles in accessing fair financial services, such as mortgage loans, business capital, and housing opportunities.

Discriminatory lending practices have been a longstanding concern, with evidence pointing to higher interest rates and more loan denials for individuals belonging to marginalized communities. This disparity in access to credit and capital hampers entrepreneurship and business growth among minority-owned enterprises, reinforcing existing economic inequality.

Unfair Competition for Emerging Adjacent Public Entities

The proliferation of emerging adjacent public entities, such as government contracts and infrastructure projects, often increases economic opportunities. However, the distribution of these contracts and options is not always equitable.

Underserved communities compete unevenly, with limited access to vital information, resources, and networking channels. As a result, established entities with better financial backing tend to secure these projects, while smaller businesses and minority entrepreneurs are left behind, furthering the marginalization of these groups.

Modern Slavery in the U.S.

Although often less visible than historical forms of slavery, modern-day exploitation, labor abuses, and sex trafficking persist.

According to the International Labor Organization (ILO), 49.6 million people were living in modern slavery in 2021, of which 27.6 million were in forced labor and 22 million in forced marriage.

The growth in trafficking is possible because the underlying conditions that make people vulnerable to sex and labor trafficking have not been addressed. Namely, poverty, environmental destruction, structural racism and discrimination, and gender and economic inequity persist as underlying drivers of human trafficking around the globe.

Economic desperation can force individuals from marginalized communities into exploitative situations, where they endure unsafe working conditions, meager wages, and little recourse for justice, perpetuating a cycle of poverty and marginalization.

Stagnation of Upward Mobility

The U.S.'s widening health and wealth gap significantly impacts upward mobility prospects for underserved groups. Limited access to quality education, healthcare, and resources creates economic advancement and social mobility barriers.

Unaffordable healthcare options and inadequate educational opportunities can perpetuate generational poverty, trapping marginalized communities in a cycle of limited economic progress.

Prioritizing Political Agendas Over Sound and Dependable Policies

While the United States has pledged its commitment to the Paris Agreement and the 2030 Sustainable Development Goals (SDGs), the reality of political agendas and business practices often runs counter to these crucial global commitments.

Despite acknowledging the urgency of addressing climate change and social inequalities, political agendas in the U.S. have often prioritized short-term interests over long-term sustainability.

Business practices prioritizing profit maximization and economic growth without considering environmental and social impacts perpetuate the health and wealth gap.

Failure to align these agendas with the Paris Agreement and SDGs undermines efforts to create a more inclusive and sustainable society and can exacerbate the challenges faced by vulnerable communities. Several vital issues highlight the dissonance between stated commitments and tangible actions in pursuing a sustainable and equitable future.

Government Policies Change Every Four Years, Lacking Consistency and Ability to Enact Meaningful Change. The continuous shifting of political landscapes due to regular elections and changes in government leadership hinders the establishment of consistent, long-term policies needed to effectively address the health and wealth gap.

As new administrations take office, priorities may change, leading to uncertainty and delays in implementing sustainable development initiatives. This lack of continuity can undermine progress and hamper the nation's ability to achieve meaningful and lasting change.

Subsidies Given to Large Carbon Emitters and Polluters - One of the most glaring contradictions to the commitment to sustainable development lies in providing subsidies to fossil fuel companies and significant carbon emitters.

These financial incentives directly contradict efforts to combat climate change and promote clean energy alternatives. Such subsidies perpetuate harmful environmental practices and divert resources from investments in renewable energy, clean technologies, and social programs to address the health and wealth gap.

Exploiting Loopholes in the Legal System and Voting Practices - In some instances, the legal system and voting practices have been manipulated to favor vested interests and impede progress toward sustainable development.

Special interest groups and corporate entities have used lobbying efforts and campaign financing to influence decision-making processes, sometimes to the detriment of marginalized communities and the environment. This undermines the democratic principles that underpin the pursuit of equitable and sustainable development goals.

The lack of transparency and accountability in the political landscape not only impedes America's commitments to the Paris Agreement and SDGs but also impacts the general welfare of the people and hinders the opportunity to expand domestic and interstate commerce.

The United States, as a major economic powerhouse, wields substantial influence in shaping the global financial and environmental landscape.

SUMMARY

Today, we live in a lopsided world where 10% of the world's population owns 76% of the wealth, takes in 52% of income, and accounts for 48% of global carbon emissions.

As a result, global health and wealth inequality, and social discontent are rising. Could these issues be on a colliding path with historic governing systems based on profits and control?

How can we work towards win-win global collaboration and discontinue the old zero-sum game run at the expense of the people and the planet? The system needs to be reformed to function with better cohesion in the general population’s interest.

In commemoration of the United States Declaration of Independence signatory day, we are today reminded of how the nation declared independence from British rule, articulated fundamental principles of democracy and individual rights, inspired other movements for independence and self-determination, and continues to serve as a symbol of American identity and values.

ABOUT READY PLAYER INSTITUTE

Ready Player Institute is a 501(c)(3) non-profit organization addressing disparities in underserved and vulnerable regions, including LATAM, the Caribbean and Pacific Islands.

Their mission is to foster greater diversity and inclusion within research and entrepreneurship, all while harnessing innovation and technology to drive sustainable solutions.

Your contribution to Ready Player Institute through Uprise will directly support individuals from minority backgrounds in underserved regions. These funds will enable them to access essential training and laboratory programs aimed at digitizing tangible assets, improving educational opportunities, advancing healthcare services, optimizing the food supply chain, and addressing the pressing issue of climate change.

Ready Player Institute collaborates closely with Project DARP, Ready Player Infrastructure, and Ready Player Ventures, forming a comprehensive network dedicated to positive change and innovation.

Your support can make a meaningful difference in their efforts to empower underserved communities and drive progress in these critical areas.

🌍 Join Us in Making a Difference! 🌱

Do you have innovative ideas, breaking news, groundbreaking research, or expert insights that can help tackle climate change, environmental pollution, and social inequity? Share your voice with the world and be a catalyst for positive change. Together, we can create a better future!

Contact us today on publishing@readyplayerinstitute.org.